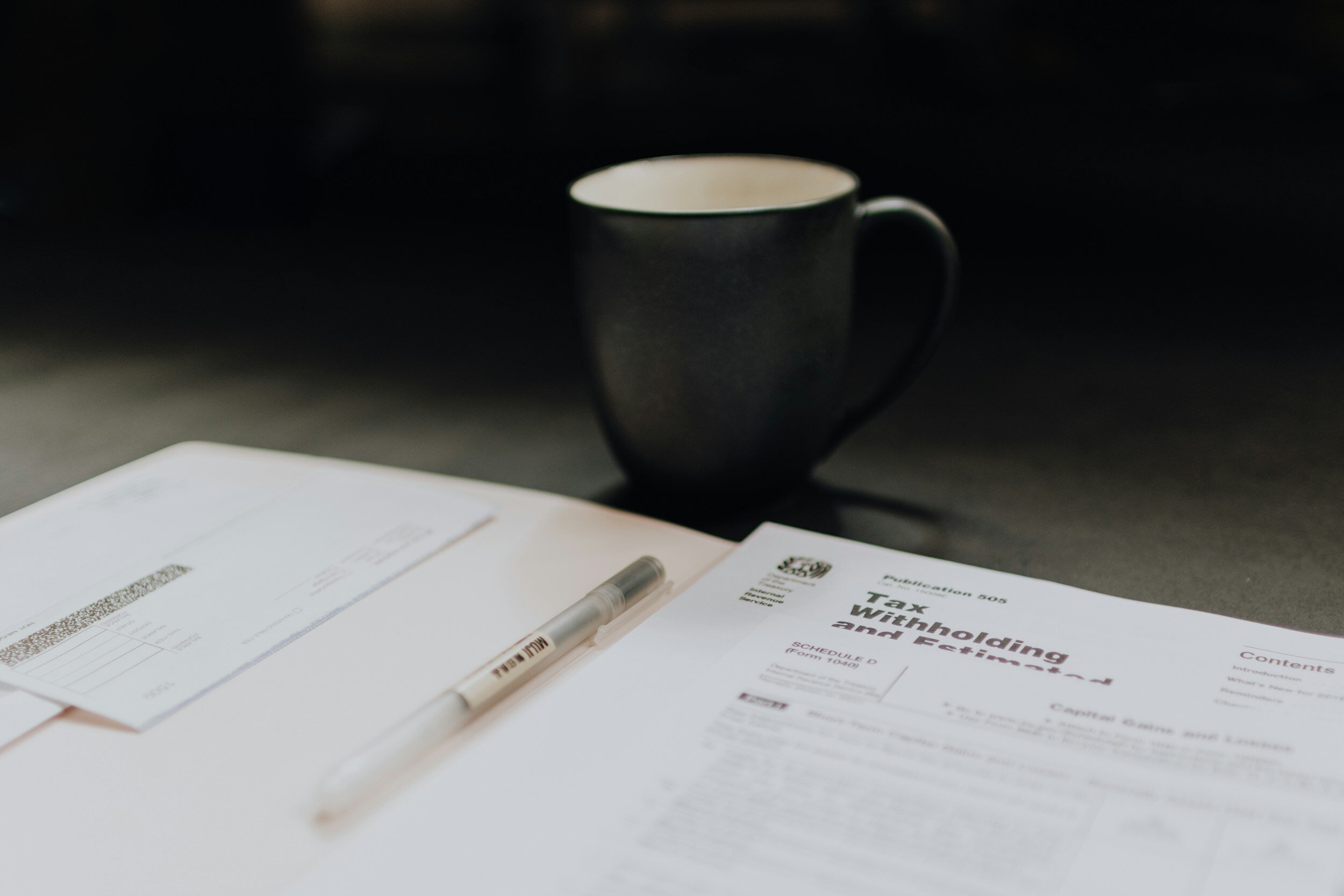

Tax Tips and Resources

Do I need to be afraid of an audit?

Facing an IRS audit can be a daunting prospect, but an audit doesn’t have to be a nightmare. Instead, with the right mindset and preparation, an audit can be just another step in ensuring your financial house is in order. Be prepared by understanding why audits happen and what to expect.

Risky Business: Tolerance and Taxes

When it comes to risk, we all have different levels of comfort. Skydiving? Yes. Eating raw meat? No. When it comes to risk, we all have different levels of comfort. Skydiving? Yes. Eating raw meat? No. One area of risk that is too often overlooked is choosing your tax preparer.

Higher taxes in 2025? Let’s hope not.

If keeping up with tax code isn’t your bread and butter, you might not remember that the Tax Cuts and Jobs Act (TCJA) even exists—and why should you? It’s your job to make the cheddar, not to figure out how to slice it. In 2025, the TCJA is scheduled to expire. What happens if it isn’t extended?

3 Questions to Ask Before Choosing a Personal Tax Advisor

Finding the right personal tax advisor can make a huge difference in your financial well-being. Ask these vital questions to make an informed decision.

What's your effective tax bracket?

Whether you like to file your taxes as early as possible or wait until April 15, there’s one thing we can all agree on: We’d all like to pay a little (or a lot) less tax. But when it comes to reducing your tax bill, where’s the best place to start? Easy: Figuring out your effective tax bracket.

Self-Employed Filing

In this article, we'll discuss the steps you need to take to file your taxes when you are self-employed.